-

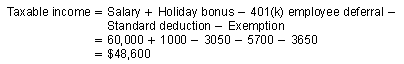

To calculate the employee's federal income tax in Example 2(b), first calculate the employee's taxable income. (This assumes the employee is single, does not have any other taxable income, and claims the standard deduction.)

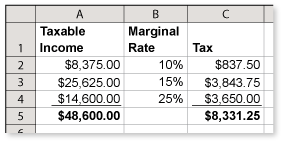

So, the taxable income is $48,600. Using the table on page 212 and a spreadsheet, you can calculate the federal income tax owed by the employee as shown.

So, the employee in Example 2 owes $8331.25 in federal income taxes.

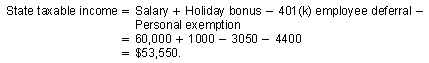

To calculate the employee's state income tax, first note that Massachusetts has a personal exemption of $4400 and does not tax employee 401(k) deferrals. So, with respect to state income taxes, the employee's taxable income is

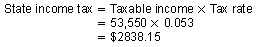

Because Massachusetts has a flat income tax rate of 5.3%, you can calculate the state income tax owed by the employee as shown. (Note that in decimal form the tax rate is 0.053.)

So, the employee in Example 2 owes $2838.15 in state income taxes.

-

Have you ever wanted to own your own business? If you have an entrepreneurial spirit but are not sure where to start, you might want to check out SCORE. SCORE is a non-profit network that offers free counseling to small business entrepreneurs.

-

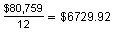

c. Divide the total compensation package by twelve to find how much the employer pays each month.

The employer pays $6729.92 each month.

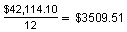

d. The employee takes home $42,114.10 each year.

The employee takes home $3509.51 each month.

e. Sample answer:

Most employees do not understand the actual costs of their total compensation package. On the other hand, most employers do not adequately communicate to employees the cost of the benefits they provide. If both parties are fully aware of the actual costs and take-home pay, they may gain a mutual respect for each other's situation and use this knowledge to reach fair compensation levels in future negotiations.

-

Comments (2)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 2 commentsSubscribe by email Subscribe by RSSGuest 6 years ago |nigger0 2Ron Larson (author)1 decade ago |This is one of my favorite examples in the book. I like how it dramatically points out two different points of view. The employer pays out about $80,000, while the employee takes home about half that amount. Amazing, isn't it? Another way to look at this is that about half of all you earn goes to pay taxes on income. This doesn't count the additional sales, excise, and property taxes that you pay.2 1