-

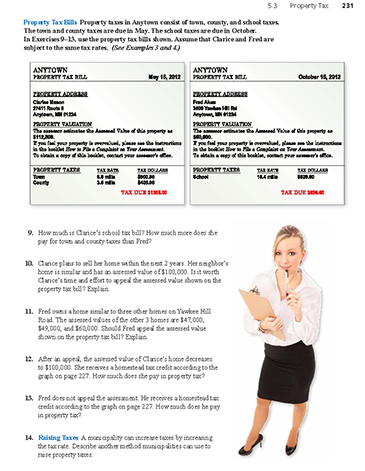

Property taxes in Anytown consist of town, county, and school taxes. The town and county taxes are due in May. The school taxes are due in October. Use the property tax bills shown. Assume that Clarice and Fred are subject to the same tax rates.

How much is Clarice's school tax bill? How much more does she pay for town and county taxes than Fred? (See Example 3 and Example 4.)

-

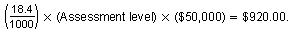

By looking at Fred's property tax bill, you can see that his school tax is

By multiplying, you can determine that the assessment level is 100%.

This implies that Clarice's school tax is

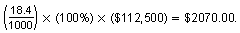

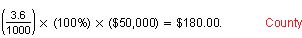

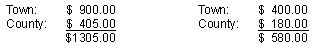

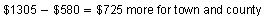

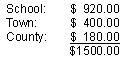

Fred's town and county property taxes are

and

The total town and county property taxes paid by Clarice and Fred are:

Clarice

Fred

So, Clarice pays

taxes than Fred pays.

taxes than Fred pays.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Property taxes in Anytown consist of town, county, and school taxes. The town and county taxes are due in May. The school taxes are due in October. Use the property tax bills shown. Assume that Clarice and Fred are subject to the same tax rates.

Clarice plans to sell her home within the next 2 years. Her neighbor's home is similar and has an assessed value of $100,000. Is it worth Clarice's time and effort to appeal the assessed value shown on the property tax bill? Explain. (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Property taxes in Anytown consist of town, county, and school taxes. The town and county taxes are due in May. The school taxes are due in October. Use the property tax bills shown. Assume that Clarice and Fred are subject to the same tax rates.

Fred owns a home similar to three other homes on Yawkee Hill Road. The assessed values of the other 3 homes are $47,000, $49,000, and $60,000. Should Fred appeal the assessed value shown on the property tax bill? Explain. ( See Example 3 and Example 4.)

-

Fred's assessment is similar to that of his neighbor's assessments. He should not appeal.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

Property taxes in Anytown consist of town, county, and school taxes. The town and county taxes are due in May. The school taxes are due in October. Use the property tax bills shown. Assume that Clarice and Fred are subject to the same tax rates.

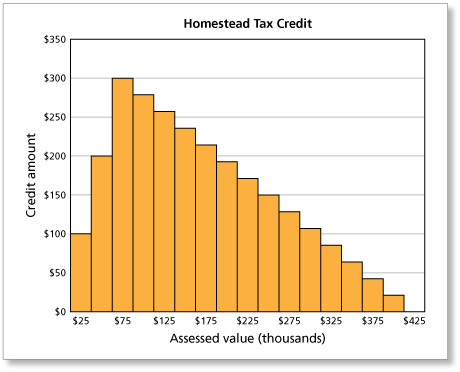

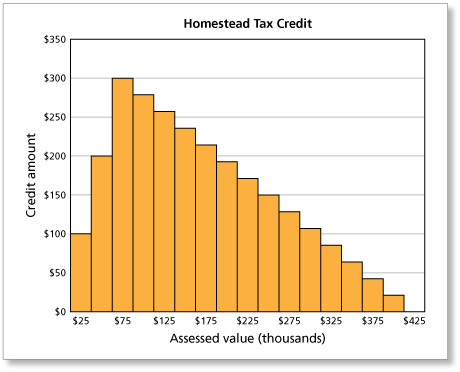

After an appeal, the assessed value of Clarice's home decreases to $100,000. She receives a homestead tax credit according to the graph on page 227. How much does she pay in property tax? (See Example 3 and Example 4.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Property taxes in Anytown consist of town, county, and school taxes. The town and county taxes are due in May. The school taxes are due in October. Use the property tax bills shown. Assume that Clarice and Fred are subject to the same tax rates.

Fred does not appeal the assessment. He receives a homestead tax credit according to the graph on page 227. How much does he pay in property tax? (See Example 3 and Example 4.)

-

From Exercise 9, add the school, town, and county taxes to find Fred's total property tax

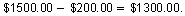

From the above graph, you can see that Fred is elligible for a homestead tax credit of $200.

So, his total property tax bill is

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

A municipality can increase taxes by increasing the tax rate. Describe another method municipalities can use to raise property taxes.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.