-

To change the tax rate in Example 4 to decimal form, divide by 1000, as shown.

-

Considering moving to another state? These tax components may influence your decision.

-

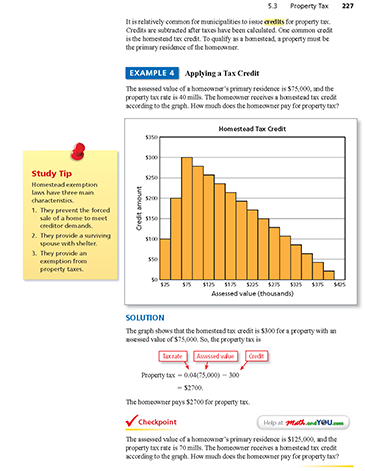

The graph shows that the homestead tax credit is about $255 for a property with an assessed value of $125,000. So, the property tax is

The homeowner pays $8495 for property tax.

-

Comments (1)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 1 decade ago |Homestead credit laws very from state to state. A common feature, however, is that they are designed to help people with low to moderate incomes.0 0