-

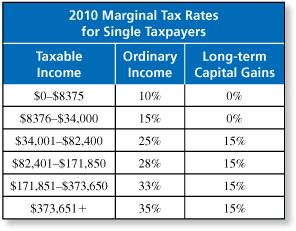

Long-term capital gains, such as profit from the sale of stock held for more than one year, are taxed at different rates than ordinary income. For instance, if you have $25,000 of ordinary income and $10,000 of income from long-term capital gains, then your income from $0 to $25,000 is taxed at the marginal rates for ordinary income and your income from $25,001 to $35,000 is taxed at the marginal rates for long-term capital gains. The income brackets are filled by ordinary income first, and then by long-term capital gains beginning on the first dollar after ordinary income.

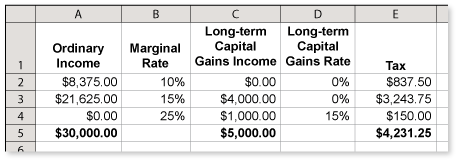

A taxpayer has $30,000 of taxable ordinary income and $5000 of taxable income from long-term capital gains. Find the income tax and the effective tax rate.

-

There are different ways to organize this tax liability. Here is one way that uses a spreadsheet.

The effective tax rate is

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

Long-term capital gains, such as profit from the sale of stock held for more than one year, are taxed at different rates than ordinary income. For instance, if you have $25,000 of ordinary income and $10,000 of income from long-term capital gains, then your income from $0 to $25,000 is taxed at the marginal rates for ordinary income and your income from $25,001 to $35,000 is taxed at the marginal rates for long-term capital gains. The income brackets are filled by ordinary income first, and then by long-term capital gains beginning on the first dollar after ordinary income.

A taxpayer has $100,000 of taxable ordinary income and $75,000 of taxable income from long-term capital gains Find the income tax and the effective tax rate.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Long-term capital gains, such as profit from the sale of stock held for more than one year, are taxed at different rates than ordinary income. For instance, if you have $25,000 of ordinary income and $10,000 of income from long-term capital gains, then your income from $0 to $25,000 is taxed at the marginal rates for ordinary income and your income from $25,001 to $35,000 is taxed at the marginal rates for long-term capital gains. The income brackets are filled by ordinary income first, and then by long-term capital gains beginning on the first dollar after ordinary income.

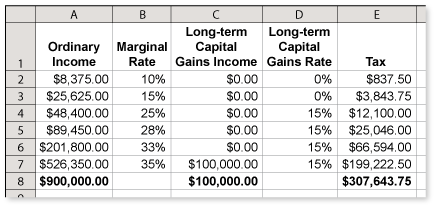

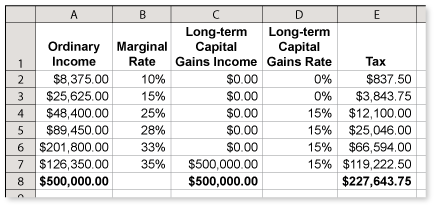

A taxpayer has a taxable income of $1,000,000.

- Find the income tax and the effective tax rate when 10% of the taxable income is from long-term capital gains.

- Find the income tax and the effective tax rate when 50% of the taxable income is from long-term capital gains.

- What happens to the effective tax rate as the percent of taxable income from long-term capital gains increases? Explain your reasoning.

-

Use a spreadsheet to calculate the tax liability.

-

If $100,000 of the income is long-term capital gains, the tax is $307,643.75.

So your effective tax rate is

-

If $500,000 of the income is long-term capital gains, the tax is $227,643.75.

So your effective tax rate is

-

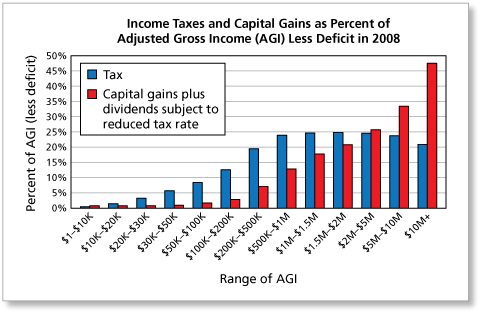

As more and more of one's income moves from ordinary income to capital gains, the effective tax rate moves closer and closer to the capital gains rate of 15%.

People who are in favor of a low tax rate for capital gains argue that the low rate encourages investment and ultimately results in more jobs. People who are opposed to a low tax rate for capital gains argue that there is no reason to give a tax break to people who use money to make money as opposed to using "sweat" to make money.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

Using the graph, explain how the taxes paid as a percent of AGI can be lower for a taxpayer in a higher income bracket than for a taxpayer in a lower income bracket.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.