-

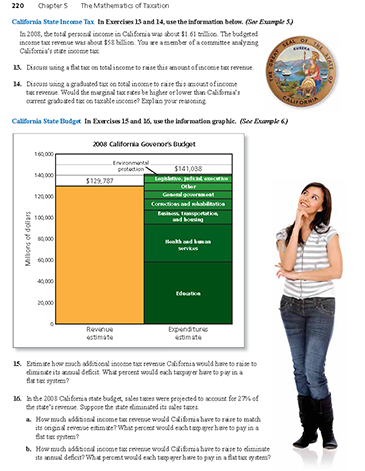

In 2008, the total personal income in California was about $1.61 trillion. The budgeted income tax revenue was about $58 billion. You are a member of a committee analyzing California's state income tax.

Discuss using a flat tax on total income to raise this amount of income tax revenue. (See Example 5.)

-

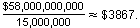

California's state income tax is graduated, going up to a marginal rate of 10.55%. Using this graduated system, California was able to raise about $58 billion in 2008. There were about 15 million state tax returns filed in California. So each taxpayer paid an average of

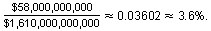

If California were to switch to a flat income tax, it could raise $58 billion by using a flat tax rate of

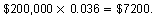

Keep in mind that switching to a flat tax rate of 3.6% would benefit the taxpayers in higher income brackets. In Example 2, a person with a taxable income of $200,000 paid about $16,800 in state income tax under the graduated system. With a flat tax rate of 3.6%, the same taxpayer would pay

While this value is still higher than the average, it is considerably lower than the graduated tax amount.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

-

In 2008, the total personal income in California was about $1.61 trillion. The budgeted income tax revenue was about $58 billion. You are a member of a committee analyzing California's state income tax.

Discuss using a graduated tax on total income to raise this amount of income tax revenue. Would the marginal tax rates be higher or lower than California's current graduated tax on taxable income? Explain your reasoning. (See Example 5.)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

In 2008, the total personal income in California was about $1.61 trillion. The budgeted income tax revenue was about $58 billion. You are a member of a committee analyzing California's state income tax.

Estimate how much additional income tax revenue California would have to raise to eliminate its annual deficit. What percent would each taxpayer have to pay in a flat tax system? (See Example 5.)

-

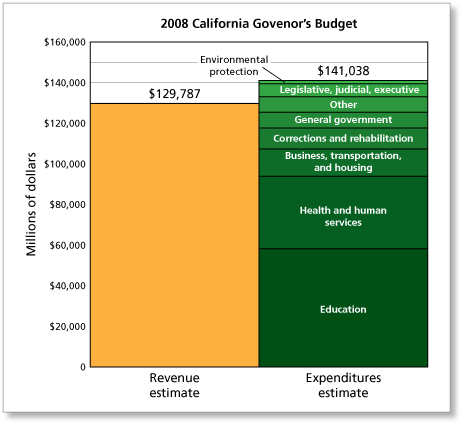

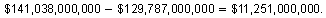

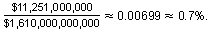

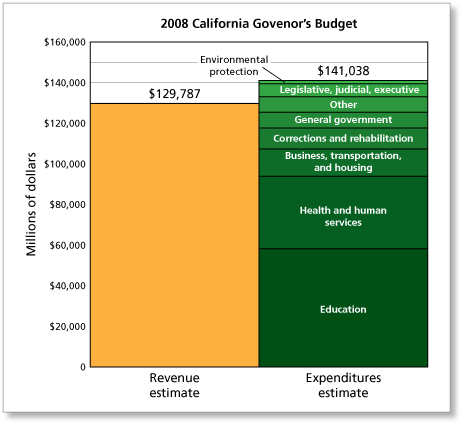

According to the above graph, California's 2008 deficit was

If California were to raise this amount using a flat income tax rate, the rate would need to be

So, the flat tax rate would have to increase from 3.6% (see Exercise 13) to 4.3%.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 3 commentsGuest 6 months ago |Where are they getting the number1,610,000,000,000 from?1 0Guest 6 months ago |I have been finding the last few lessons super confusing. At the beginning of the year I thought I would start liking math, but I guess math is always just math.1 0Guest 7 years ago |hello0 0 -

-

In the 2008 California state budget, sales taxes were projected to account for 27% of the state's revenue. Suppose the state eliminated its sales taxes. (See Example 6.)

- How much additional income tax revenue would California have to raise to match its original revenue estimate? What percent would each taxpayer have to pay in a flat tax system?

- How much additional income tax revenue would California have to raise to eliminate its annual deficit? What percent would each taxpayer have to pay in a flat tax system?

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.