-

Note: You may want to review the Math Help for page 216 before continuing.

To perform the division in Example 6, note that you can write

This fraction is easier to enter into a calculator (or to use in long division) than the original fraction. After dividing

you obtain the same answer shown in Example 6.

-

To learn more about the United States' budget deficit, visit federalbudget.com, which is sponsored by the National Debt Awareness Center.

-

Sample answer:

The first thing I would do is try to minimize Social Security, Medicare, and Medicaid fraud. The penalties for fraud need to be severe to prohibit these crimes, reduce expenditures, and increase revenue through fines. I would then cut the fat from other mandatory programs, and eliminate pet projects that fall into this category. Most non-defense spending programs would be put on hold for at least one year. Any remaining deficit would have to be settled by cutting defense spending.

-

Comments (4)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

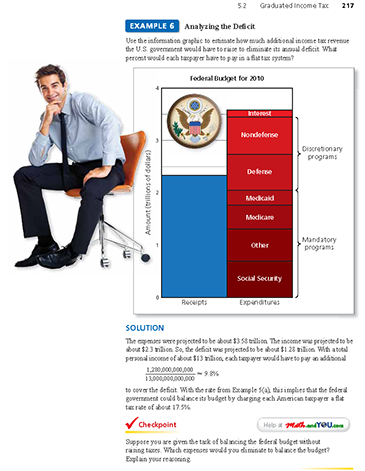

When posting a comment, you agree to our Terms of Use.Showing 4 commentsSubscribe by email Subscribe by RSSJackie (moderator)1 decade ago |You are correct there is an error, and that the flat tax rate should be 27.5%. It appears the error is the assumption the flat tax should bring in an income of $2.3 trillion. But this did not take into effect the deficit of $1.28 trillion. Combining both income and deficit, the flat tax would need to bring in $3.58 trillion, which translates to a rate of 27.5%. I hope this helps. Thank you for bringing this to our attention. We will fix this for the next edition.0 0Guest 1 decade ago |I think the solution to Example 6 may be in error--- and maybe it's my error. In any event, shouldn't the flat tax amount to 27.5% instead of 17.5%. The $13 trillion divided into a total tax requirement of $3.58 trillion equates to 27.5%. The error is in referring to example 5a, where the suggestion is that the tax revenue is $1 trillion instead of $3.58 trillion mentioned in this problem. Where am I wrong?0 0Guest 1 decade ago |The federal government can easily cut its budget if it required more efficiency from its government workers. It could cut out 25% of the workers and still continue to do the same amount of damage as it currently does.1 1Ron Larson (author)1 decade ago |Isn't the graph in Example 6 amazing? How would you balance the two columns? To balance them, you either have to raise the blue column (in which half of the people in the country will hate you) or you have to shrink the red column (in which the other half of the people in the country will hate you).0 0