-

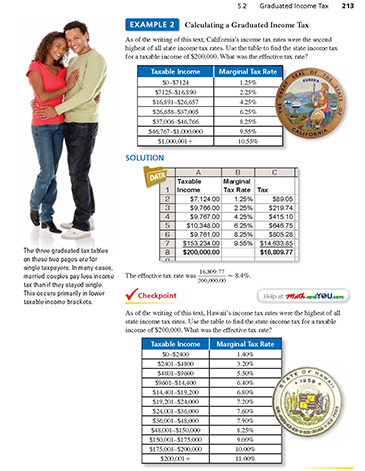

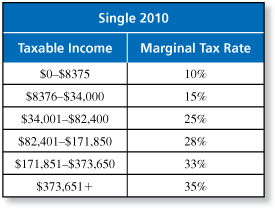

Using a spreadsheet is an easy way to calculate a graduated income tax, as shown in Examples 1 and 2.

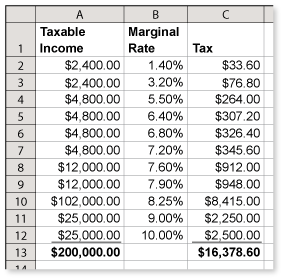

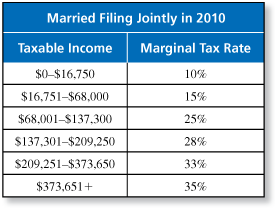

Also notice that the tax tables on pages 212 and 213 are for single taxpayers. The tables below show the graduated income tax for the taxable income (after deductions) of a married couple filing jointly or separately in 2010. Compare the rates with the single taxpayer table (also shown below). (See also Exercises 1-6.)

-

Did you know that Hawaii is one of only two states, the other being Arizona, that does not observe daylight saving time? To learn more, visit webexhibits.org to view a neat interactive presentation all about daylight saving time.

-

Use a spreadsheet to calculate the income tax owed.

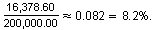

The state income tax is $16,378.60.

The effective tax rate is

-

Comments (2)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 2 commentsSubscribe by email Subscribe by RSSGuest 1 year ago |hojye0 0Guest 1 decade ago |When Obama was running for president, I remember that he wanted to remove the cap on Social Security tax and also wanted to increase the highest income tax rate to 40%. That means that as a self employed business person in California, I would be paying 40% (IRS) + 10.55% (CA) + 15% (SS) = 65.55% of my income for state and federal taxes! How is it that a person can think this is right? I guess this is the definition of socialism. I am allowed to keep one-third, the government takes two-thirds.1 2