-

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

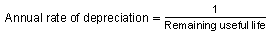

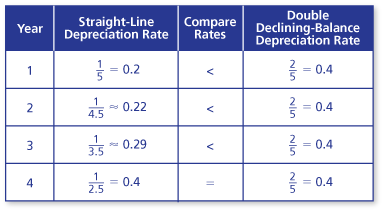

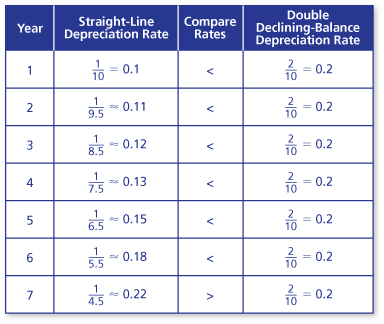

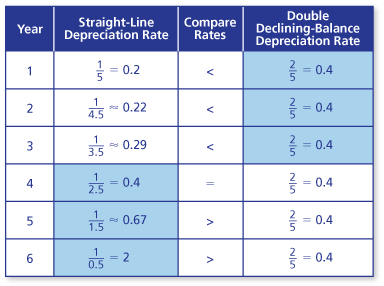

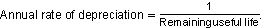

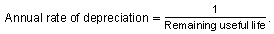

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

Using the method described above, in which year do you switch to straight-line depreciation for an asset with the given useful life?

- 5 years

- 10 years

-

- Begin by making a table that compares the rates of depreciation for straight-line depreciation and double declining-balance depreciation for each year.

In year 4, the straight-line depreciation rate is equal to the double declining-balance depreciation rate. So, you switch to straight-line depreciation in year 4.

- Begin by making a table that compares the rates of depreciation for straight-line depreciation and double declining-balance depreciation for each year.

In year 7, the straight-line depreciation rate is greater than the double declining-balance depreciation rate. So, you switch to straight-line depreciation in year 7.

- Begin by making a table that compares the rates of depreciation for straight-line depreciation and double declining-balance depreciation for each year.

Comments (0)These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 0 commentsSubscribe by email Subscribe by RSSThere are no comments. -

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

Using the method described above, in which year do you switch to straight-line depreciation for an asset with the given useful life?

- 3 years

- 7 years

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

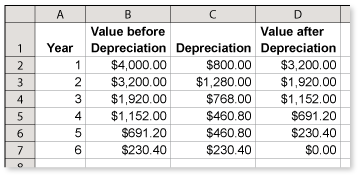

You purchase a $4000 copy machine. The useful life of the machine is 5 years. Make a depreciation schedule using the method described above.

A spreadsheet is available to help you complete this exercise.

-

From Exercise 21, if an item has a useful life of 5 years, switch from double declining-balance depreciation to straight-line depreciation in year 4. The table shows the depreciation rates used for each year.

Also remember that the depreciation deduction in the first and last year are reduced by half.

A spreadsheet showing the depreciation schedule is shown below.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

You purchase a $10,000 knitting machine. The useful life of the machine is 5 years. Make a depreciation schedule using the method described above.

A spreadsheet is availabe to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

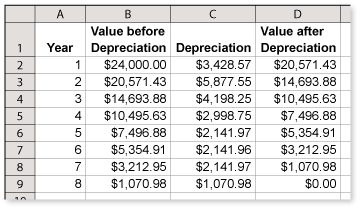

You purchase a $24,000 digital printing press. The useful life of the machine is 7 years. Make a depreciation s chedule using the method described above.

A spreadsheet is available to help you complete this exercise.

-

From Exercise 22, if an item has a useful life of 7 years, switch from double declining-balance depreciation to straight-line depreciation in year 5. The table shows the depreciation rates used for each year.

Also remember that the depreciation deduction in the first and last year are reduced by half.

A spreadsheet showing the depreciation schedule is shown below.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use. -

-

You can also use the modified accelerated cost recovery system (MACRS) to depreciate assets. One method available under MACRS is double declining-balance depreciation with a switch to straight-line depreciation.

Under this method, you compare the annual rates of depreciation for double declining-balance depreciation and straight-line depreciation each year. When the rate for straight-line depreciation is greater than or equal to the rate for double declining-balance depreciation, you switch to straight-line depreciation. The annual rate of depreciation for straight-line depreciation is given by

In the exercises, you should use the half-year convention, which begins depreciation halfway through the year that an asset is put into service. An asset with a useful life of n years will have a depreciation schedule with n + 1 years because you start and end the useful life halfway through the year. For straight-line depreciation, the remaining useful life in year 2 is n − 1/2. After year 2, the remaining useful life decreases by 1 each year. For both methods, the depreciation deduction in the first year and last year are reduced by half. (Note: Salvage value is not used under MACRS.)

You purchase a $3000 ticket booth. The useful life of the booth is 7 years. Make a depreciation schedule using the method described above.

A spreadsheet is available to help you complete this exercise.

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.