-

In Example 4, the salvage value is $25,000. From a practical standpoint, salvage value is often considered to be $0, because its valuation is often small and immaterial. For instance, after 5 years, a certain computer is considered obsolete. So, the computer has a salvage value of $0.

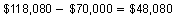

Spreadsheet for Example 4.

-

Have you ever wondered how the Internet works, or how computers retrieve information from servers? Check out this article on How Stuff Works to learn more about how servers work, and how information is transferred over the Internet. While you're there you might want to look around at some of the other interesting articles detailing how stuff works.

-

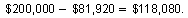

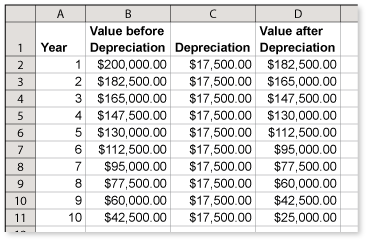

Using the spreadsheet from Example 4, you can see that the value expensed during the first 4 years using double declining-balance depreciation was

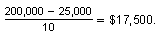

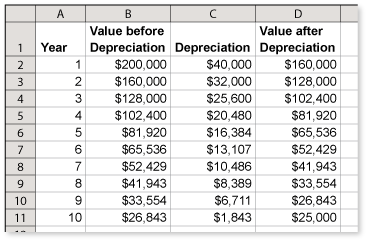

For straight-line depreciation, the annual depreciation would be

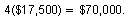

After 4 years, the total depreciation expense is

The spreadsheet below confirms that the total depreciation during the first 4 years is

The spreadsheet below confirms that the total depreciation during the first 4 years is

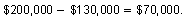

So, using double declining-balance depreciation, we expensed

more during the first 4 years than we would have with straight-line depreciation.

more during the first 4 years than we would have with straight-line depreciation.You can check your work using a depreciation schedule calculator located in Tools.

-

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.

You can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. You also can depreciate certain intangible property, such as patents, copyrights, and computer software. To be depreciated, the property must meet all the following requirements.

* It must be property you own.

* It must be used in your business or income-producing activity.

* It must have a determinable useful life.

* It must be expected to last more than one year.