-

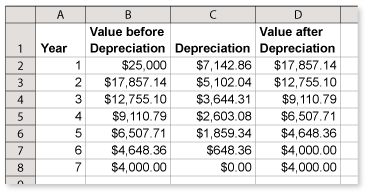

You have already seen that the annual depreciation in the straight-line method is the same each year. While relatively easy to calculate, straight-line depreciation is not really very representative of the way most items depreciate. Typically, depreciation is greatest in early years and levels off in later years. For instance, new cars usually depreciate more in the first year than in the second, more in the second than in the third, and so on. This feature of depreciation is built into double declining-balance depreciation, as shown in Example 3. Note in the spreadsheet and bar graph in Example 3 how the value depreciates the greatest in the first few years and levels off for the last few years.

-

If words like double declining balance excite you, you might want to consider getting a degree in accounting. Accounting is one of the most in demand jobs in America right now, and individuals who have earned the title CPA, or, Certified Public Accountant, will be in high demand in the job market.

For more information on obtaining your CPA license check out the American Institute of CPAs website.

-

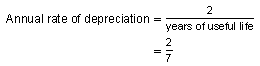

Find the annual rate of depreciation.

A spreadsheet showing the depreciation schedule is shown below.

Note that depreciation in the sixth and seventh years is adjusted so that the equipment depreciates to its salvage value, $4000.

You can check your work using a depreciation schedule calculator located in Tools.

-

Comments (1)

These comments are not screened before publication. Constructive debate about the information on this page is welcome, but personal attacks are not. Please do not post comments that are commercial in nature or that violate copyright. Comments that we regard as obscene, defamatory, or intended to incite violence will be removed. If you find a comment offensive, you may flag it.

When posting a comment, you agree to our Terms of Use.Showing 1 commentsSubscribe by email Subscribe by RSSGuest 1 decade ago |As long as your depreciation method is "rational and reasonable", the IRS allows you to create many different types of depreciation schedules. For instance, in the formula on page 186, you could substitute 1.5 for 2. This would be called a "150% Declining Balances Method".0 0